Free School Meals & Pupil Premium

Free School Meals

Your child will be eligible for free school meals if you (or your partner) are in receipt of any of the following:

- Income Support

- Income-based Jobseeker's Allowance

- Income-related Employment and Support Allowance

- support under Part VI of the Immigration and Asylum Act 1999

- the guaranteed element of Pension Credit

- Child Tax Credit (but not Working Tax Credit) and your annual gross income (as assessed by HM Revenue and Customs) is not more than £16,190

- Working Tax Credit 'run on' – paid for 4 weeks after you stop qualifying for Working Tax Credit

- Universal Credit and net earnings, from your last assessment period, is not more than £616.67 per month. (If your household's net earnings change each month then they should not exceed £1,233.34 in the last two consecutive months or £1,850 in the past 3 months).

Once eligible, your child will continue to receive free school meals in primary or secondary school until at least 31 March 2022 and then until the end of their current phase of education, i.e. primary (Year 6) or secondary (Year 11). After this period, you may need to reapply.

Pupil Premium

Your child’s school will also receive additional funding if you are in receipt of a qualifying award listed above. It is therefore important that you claim free school meals and the pupil premium even if your child does not wish to take a school meal or your child is in Reception, Year 1 or Year 2 and already receives an infant free school meal.

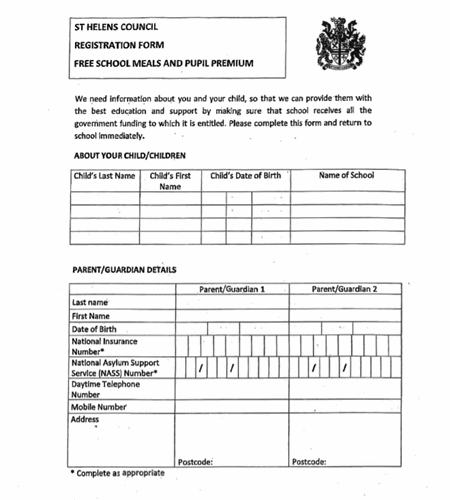

Alternatively you can download a paper copy by clicking on the link below.